Introduction

As cryptocurrency gains popularity, many individuals who own or trade cryptocurrencies are facing the question of how to properly report their gains and losses for tax purposes. The lack of clear guidelines and regulations surrounding cryptocurrency taxes can make it challenging for individuals to navigate the process. In this blog post, we will explore what you need to know about crypto taxes before filing.

What is Cryptocurrency?

Before diving into the details of crypto taxes, it's important to understand what cryptocurrency is. Cryptocurrency is a digital or virtual currency that uses encryption techniques to regulate the generation of units and verify the transfer of funds. Bitcoin is the most well-known and widely used cryptocurrency, but there are thousands of other cryptocurrencies available.

Is Cryptocurrency Taxable?

The short answer is yes, cryptocurrency is taxable. The Internal Revenue Service (IRS) treats cryptocurrency as property for tax purposes. This means that like stocks, bonds, and real estate, gains and losses from the sale or exchange of cryptocurrency are subject to capital gains tax. In general, cryptocurrencies are treated as property for tax purposes, meaning that gains or losses from the sale or exchange of cryptocurrencies are subject to capital gains tax. This means that if you sell or exchange cryptocurrency for a profit, you will owe taxes on that profit. Similarly, if you sell or exchange cryptocurrency for a loss, you may be able to deduct that loss from your taxable income.

It's important to note that the tax treatment of cryptocurrency can vary depending on the country and jurisdiction in which you live. Some countries may have specific regulations or laws that affect how cryptocurrency is taxed, while others may not yet have clear guidelines on the matter. In addition, the tax treatment of cryptocurrency can also depend on the specific circumstances of each transaction, such as the amount of cryptocurrency involved, the length of time it was held, and the purpose of the transaction. As such, it's important for cryptocurrency investors and traders to consult with a tax professional or accountant to ensure that they are compliant with all applicable tax laws and regulations.

When is Cryptocurrency Taxable?

Cryptocurrency is taxable when it is sold or exchanged for fiat currency (such as USD) or used to purchase goods or services. Additionally, if cryptocurrency is held for investment purposes, any increase in value is considered a capital gain and is subject to taxation when realized. For example, if you purchased 1 Bitcoin for $5,000 and sold it for $10,000, you would have a capital gain of $5,000. This capital gain would be taxable at the appropriate capital gains tax rate. If you mine cryptocurrency, the value of the mined coins is considered taxable income at the time they are received. The amount of taxable income is equal to the fair market value of the cryptocurrency on the date it was received. Additionally, if you use cryptocurrency to purchase goods or services, the transaction may be subject to sales tax, similar to other purchases made with traditional currency.

It's important to note that cryptocurrency can also be subject to tax in other situations, such as when it is received as payment for goods or services or when it is mined. In these cases, the tax treatment may vary depending on the specific circumstances and the tax laws and regulations in your country or jurisdiction. As such, it's important for cryptocurrency investors and traders to keep careful records of all their transactions and consult with a tax professional or accountant to ensure that they are compliant with all applicable tax laws and regulations.

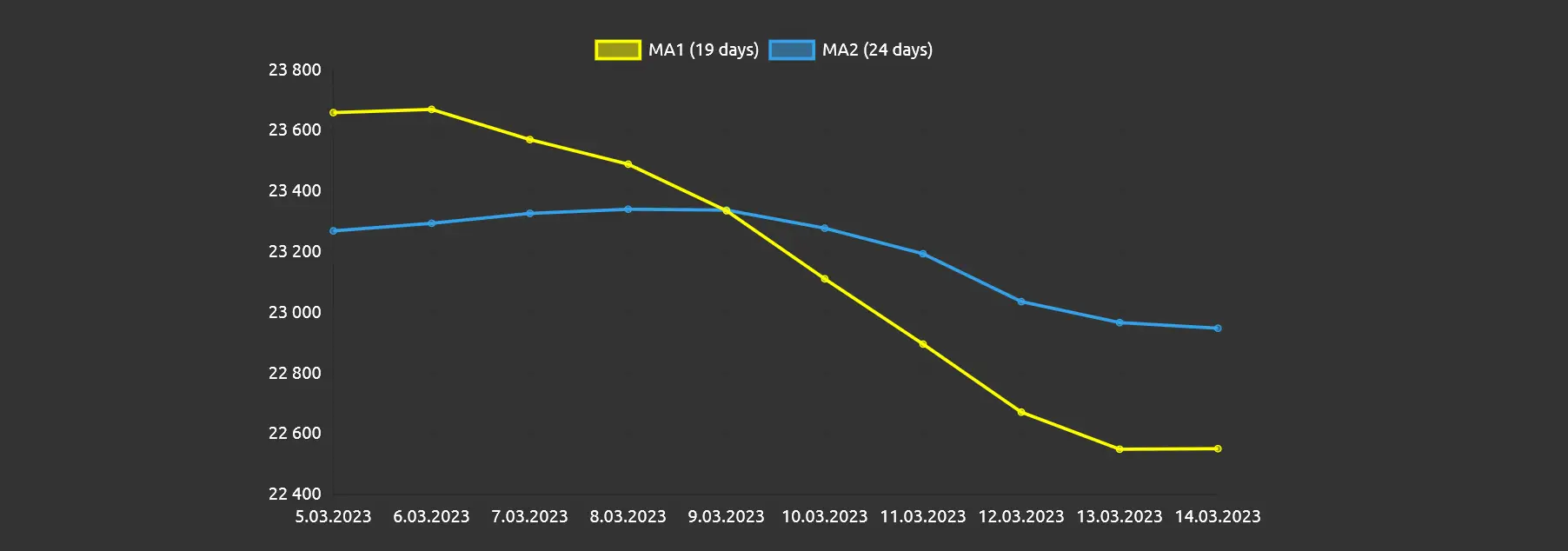

What are the Tax Rates for Cryptocurrency?

The tax rates for cryptocurrency depend on how long you held the cryptocurrency before selling or exchanging it. If you held the cryptocurrency for more than one year, any gains are considered long-term capital gains and are subject to lower tax rates. If you held the cryptocurrency for less than one year, any gains are considered short-term capital gains and are subject to higher tax rates The long-term capital gains tax rates for cryptocurrency are:

- 0% for individuals in the 10% or 12% tax bracket

- 15% for individuals in the 22%, 24%, 32%, or 35% tax bracket

- 20% for individuals in the 37% tax bracket or higher

How to Report Cryptocurrency Taxes

Reporting cryptocurrency taxes can be a complicated process, but there are several steps you can take to make it easier.

Step 1: Keep Track of Your Transactions

The first step to properly reporting cryptocurrency taxes is to keep track of all your transactions. This includes every purchase, sale, exchange, and use of cryptocurrency. You should record the date of the transaction, the amount of cryptocurrency involved, and the fair market value of the cryptocurrency at the time of the transaction.

Step 2: Calculate Your Gains and Losses

Once you have recorded all your transactions, you need to calculate your gains and losses. To do this, subtract the cost basis (the amount you paid for the cryptocurrency) from the fair market value of the cryptocurrency at the time of the transaction.

If the result is positive, you have a capital gain. If the result is negative, you have a capital loss. You should record each gain or loss separately.

Step 3: Determine Your Taxable Income

After you have calculated your gains and losses, you need to determine your taxable income. Add up all your capital gains and losses for the year. If you have a net capital gain, it is subject to

Resources

- https://www.forbes.com/advisor/taxes/cryptocurrency-taxes/

- https://www.nerdwallet.com/article/investing/bitcoin-taxes

- https://www.investopedia.com/tech/taxes-and-crypto/

- https://www.zenledger.io/guides/crypto-tax-us

- https://pro.bloombergtax.com/brief/cryptocurrency-tax-laws-by-state/

Author

- click on the author to see more information.