Introduction

Cryptocurrencies are a popular investment option for many people around the world. In recent years, staking has emerged as a new way for cryptocurrency holders to earn passive income. Staking involves locking up a certain amount of cryptocurrency as collateral to support the network and earn rewards. In this post, we'll explore the pros and cons of staking cryptocurrency. Staking cryptocurrency is a process that involves holding and locking up a certain amount of a cryptocurrency in order to help validate transactions on its blockchain network. This is known as Proof of Stake (PoS) consensus, which is an alternative to the more traditional Proof of Work (PoW) consensus used by cryptocurrencies like Bitcoin. When a user stakes their cryptocurrency, they are essentially contributing to the security and efficiency of the network, and in return, they receive rewards in the form of additional cryptocurrency. The rewards are distributed based on the amount of cryptocurrency staked, with larger stakers receiving a larger share of the rewards.

Staking has become an increasingly popular way for users to earn passive income from their cryptocurrency holdings, as well as to contribute to the growth and security of their favorite blockchain projects. In addition to the financial benefits, staking can also help to reduce the environmental impact of cryptocurrency mining, as it does not require the high levels of energy consumption associated with PoW mining. Many cryptocurrency exchanges and wallets now offer staking services, making it easier than ever for users to participate in staking and earn rewards for their contributions to the network.

The Pros of Staking Cryptocurrency

Passive Income

One of the biggest advantages of staking cryptocurrency is the potential to earn passive income. When you stake your cryptocurrency, you become a validator on the network, and you earn rewards for helping to secure and validate transactions. These rewards can be significant, especially if you're staking a large amount of cryptocurrency.

Reduced Volatility

Another advantage of staking cryptocurrency is that it can help to reduce volatility. When you stake your cryptocurrency, you're effectively taking it out of circulation for a period of time. This can help to reduce the supply of the cryptocurrency and increase its value over time.

Network Security

By staking cryptocurrency, you're also helping to support and secure the network. When you stake your cryptocurrency, you become a validator on the network, which means that you're helping to validate transactions and maintain the integrity of the blockchain. This can help to improve the overall security and reliability of the network.

No Specialized Equipment Needed

Unlike mining, which requires specialized equipment and a significant amount of electricity, staking cryptocurrency requires no specialized equipment. All you need is a computer or mobile device and an internet connection.

Long-Term Investment

Staking cryptocurrency can be a good long-term investment strategy. By staking your cryptocurrency, you're essentially investing in the future of the network. If the network grows and becomes more popular over time, the value of the cryptocurrency is likely to increase as well.

The Cons of Staking Cryptocurrency

Risk of Loss

As with any investment, there is always the risk of loss when staking cryptocurrency. If the value of the cryptocurrency decreases significantly, you could lose a significant amount of money.

Liquidity Issues

When you stake your cryptocurrency, it's locked up for a period of time. This means that you won't be able to access it for a certain period of time. This lack of liquidity can be problematic if you need access to your funds for any reason.

Technical Knowledge Required

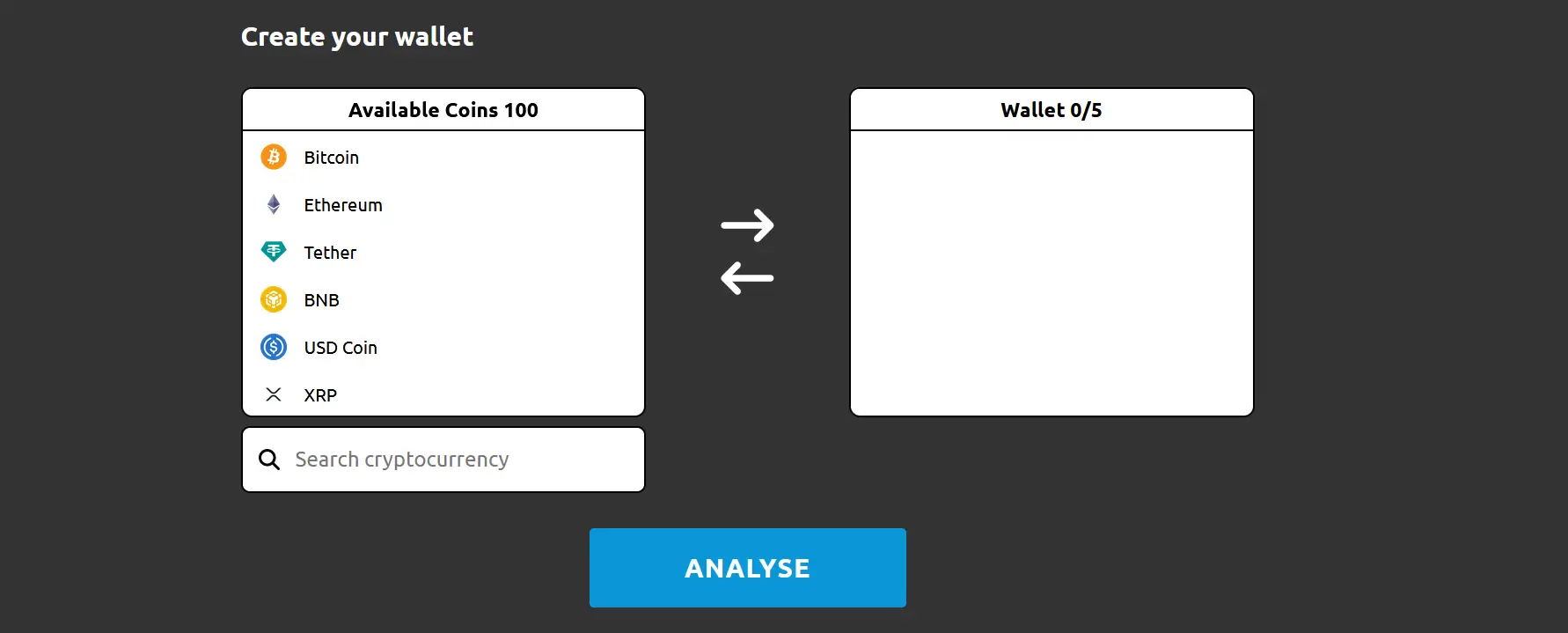

Staking cryptocurrency requires some technical knowledge. You need to know how to set up a staking wallet, how to transfer your cryptocurrency to the wallet, and how to stake your cryptocurrency. If you're not comfortable with technology, staking cryptocurrency may not be the right investment option for you.

Staking Requirements

Different cryptocurrencies have different staking requirements. Some cryptocurrencies require a significant amount of cryptocurrency to be staked, while others require only a small amount. If you don't have enough cryptocurrency to meet the staking requirements, you won't be able to stake your cryptocurrency.

Centralization Risks

Staking can also lead to centralization risks. When a small group of validators controls a significant amount of the cryptocurrency, it can lead to centralization, which can reduce the overall security and reliability of the network.

Conclusion

Staking cryptocurrency can be a great way to earn passive income and support the network. However, it's important to understand the risks involved before you start staking. By considering the pros and cons of staking cryptocurrency, you can make an informed decision about whether it's the right investment option for you. If you do decide to start staking, be sure to do your research and choose a reputable staking service or wallet to ensure the safety. Staking cryptocurrency is a powerful tool that allows users to earn passive income while contributing to the growth and security of blockchain networks. As the cryptocurrency industry continues to evolve, it's likely that staking will become an increasingly popular way for users to engage with their favorite projects and earn rewards for their contributions. However, it's important to note that staking involves some level of risk, as the value of cryptocurrencies can be volatile and the rewards may not always be guaranteed. As with any investment, it's important for users to do their research and carefully consider their options before staking their cryptocurrency. Overall, staking offers an exciting opportunity for users to participate in the growing cryptocurrency ecosystem and earn rewards for their contributions to its continued success.

Resources

- https://www.coinbase.com/learn/crypto-basics/what-is-staking

- https://www.forbes.com/advisor/investing/cryptocurrency/crypto-staking-basics/

- https://www.forbes.com/advisor/investing/cryptocurrency/best-crypto-staking-platforms/

- https://www.fool.com/investing/stock-market/market-sectors/financials/cryptocurrency-stocks/what-is-staking/

- https://www.stakingrewards.com/

Author

- click on the author to see more information.